JLL: Secondary Markets Will Drive 2024 Data Centre Growth

There is a need for data centres to be designed and operated to meet the evolving needs of the global digital economy.

With the industry continuing to boom during a time of unprecedented demand, data centres are facing continued challenges of power availability and needing to secure sustainable sources of power.

In considering this, JLL’s new EMEA data centre report has found that in 2023, there will be a 16% increase in data centre supply.

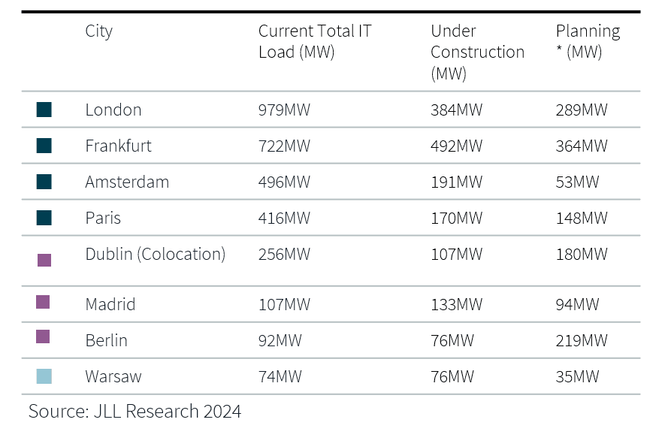

With 467MW added to Europe’s core markets of Frankfurt, London, Amsterdam, Paris and Dublin (FLAPD), the report highlights strong data centre demand shifting towards new markets across Europe.

These secondary markets will also see significant growth in 2024, according to JLL, with Madrid, Berlin and Warsaw expected to see an average 49% increase to their market size. Madrid alone is expected to have 58MW of new supply added.

Expanding locations to meet digital transformation demand

As these rapidly evolving technologies continue to place demands on data centres, it is expected that global electricity demand will double by 2026. This highlights the importance of those within the data centre industry investing in sustainability and net zero initiatives.

Likewise, JLL finds reporting requirements are beginning to drive activity in Europe’s secondary markets.

“In a world increasingly fuelled by the internet, data, and artificial intelligence (AI), demand will continue to rise for real estate to make it all happen. We saw record levels of take up, demand and preleasing for data centres in 2023, and expect 2024 to be another staggering year for activity in the sector,” says Tom Glover, Head of Data Centre Transactions, EMEA at JLL.

An increased need for data centres across Europe resulted in record-level demand in 2023, which is expected to triple in size across the EMEA region by 2023, according to a previous report by JLL.

The company’s latest report attests to the fact that 2023 was an exceptional year for the industry, with record levels of interest across FLAPD markets - reaching a 19 YoY increase of 352MW.

Continued emergence of secondary markets

Likewise, the report finds that a total of 391MW of new supply came online, with 161MW added in the last quarter alone. This is the biggest yearly increase seen in the core dara market, having grown by 16%.

Frankfurt is a particular location that dominated 2023 by both market growth and take up, which JLL expects to continue in 2024. However, it also notes that London will start to make a comeback after 2023 saw lower market growth.

Secondary or emerging markets are also expected to grow by an average of 17%, with Europe and the Nordics set to grow between 30-55% over the next year. JLL predicts that this is because data centre developments will start expanding to locations where there is greater available power and land.

These markets will therefore be critical in countering supply challenges.

Daniel Thorpe, Data Centre Research Lead, EMEA at JLL, comments: “While we saw additional supply come to market, it’s still struggling to keep pace with the staggering levels of demand for data centre capacity, creating an ongoing imbalance. We expect demand for space in 2024 will continue to be incredibly high, particularly in core markets, leading to low vacancy rates for new space and upward pressure on rents.

******

Make sure you check out the latest edition of Data Centre Magazine and also sign up to our global conference series - Tech & AI LIVE 2024

******

Data Centre Magazine is a BizClik brand